Which of the Following Are Direct Roles of Commercial Banks

Cover the functions of a commercial bank. Currency in the hands of the public and checkable deposits are components of _____.

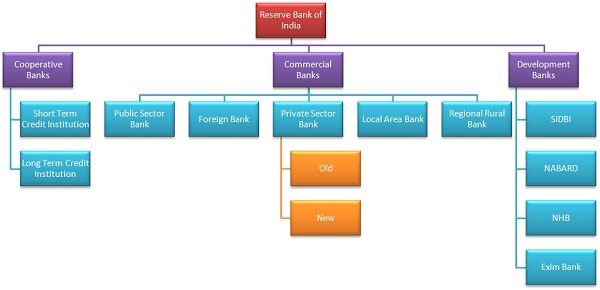

Difference Between Commercial Bank And Development Bank With Table Ask Any Difference

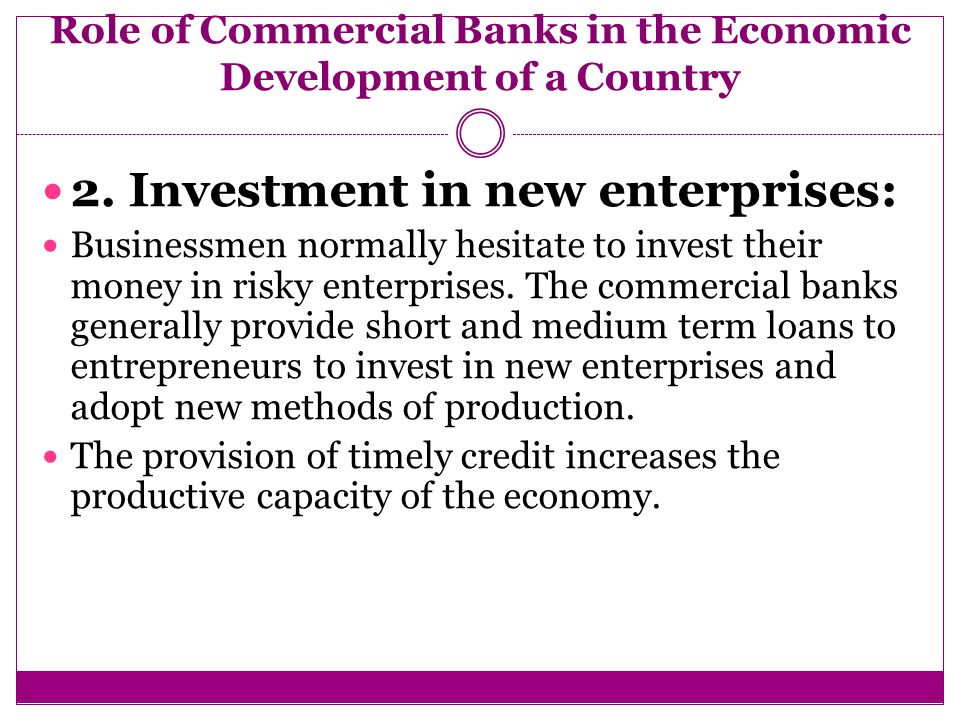

The following points highlight the top eight roles of commercial banks in a developing country.

. Cash is perfectly accessible or perfectly _____ one word. Commercial Bank in India comprises the State Bank of. A commercial banking career path has you providing clients Corporate The Corporates section of our interactive Career Map will tell you about salaries skills personalities courses you need to work at a corporate issuer with credit products such as term loans revolving lines of credit syndicated facilities cash management services.

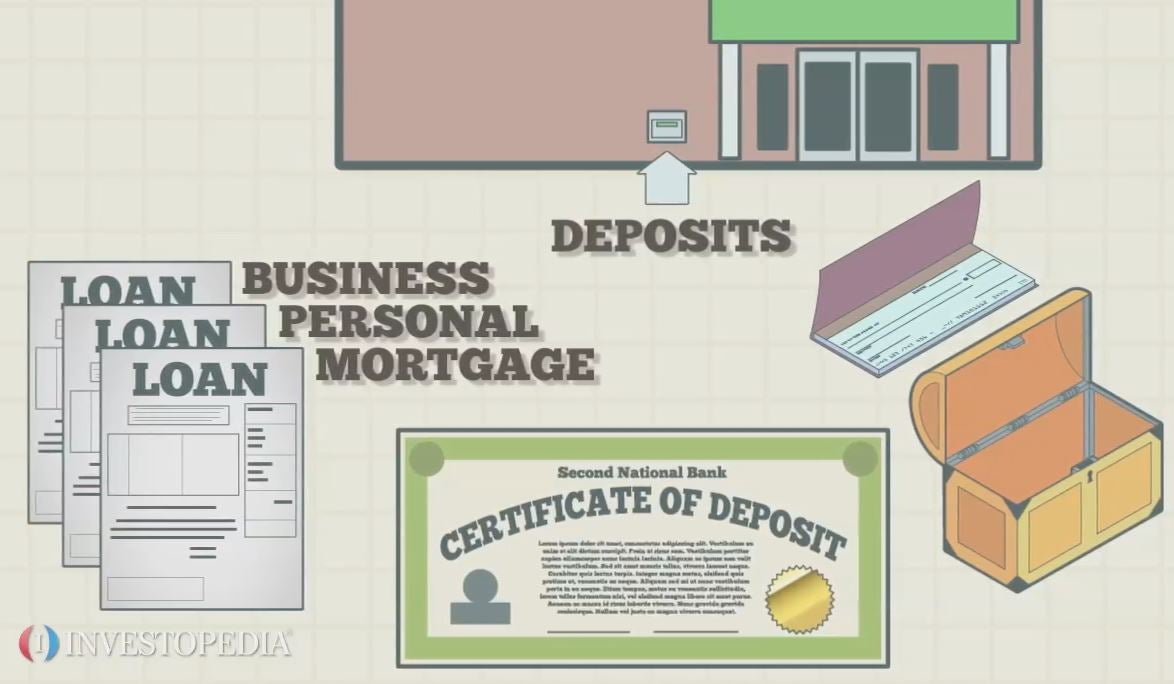

Accepting deposits is one of the oldest functions of a commercial bank. Accept deposits of households and businesses. Saving deposits Current deposits and fixed deposits.

Money supply M1 includes all components of M2. When banks started they charged a commission for keeping money on behalf of the public. They play a vital role in financing agriculture in a country.

The deposits may be of three types. They help the finance industry through underwriting services and developing capital markets. Some of the roles are.

The general role of commercial banks is to provide financial services to general public and business ensuring economic and social stability and sustainable growth of the economy. A commercial bank performs the following functions. They Help in Monetary Policy and Others.

Which of the following is a function of commercial bank loans. The most significant and traditional function of commercial bank is accepting deposits from the public. What is ti called when banks bundle hundreds of mortgages and sell them as bonds.

In addition to this primary function the central bank performs the following duties. Commercial banks are financial institutions that provide finance and investing services for businesses. The lesson features the following objectives.

Check all that apply. The currency of the United States consists primarily of metal coins and paper money. Commercial banks play several roles as financial intermediaries.

Existence of a Large Non-monetized Sector 3. Commercial Banks helps in mobilizing savings for capital formation through deposit schemes branch banking etc. Direct roles of commercial banks.

Commercial banks are the most common type of financial institution. Mobilising Saving for Capital Formation. Accept deposits of households and businesses Make available a wide variety of loans Keep money safe until demanded Commercial bank _____ provide short-term financial capital to businesses and the financing of consumer purchases such as durable goods.

The first task is therefore the collection of the savings of the public. Commercial Banking Career Overview. It collects the surplus balances of the Individuals firms and finances the temporary needs of commercial transactions.

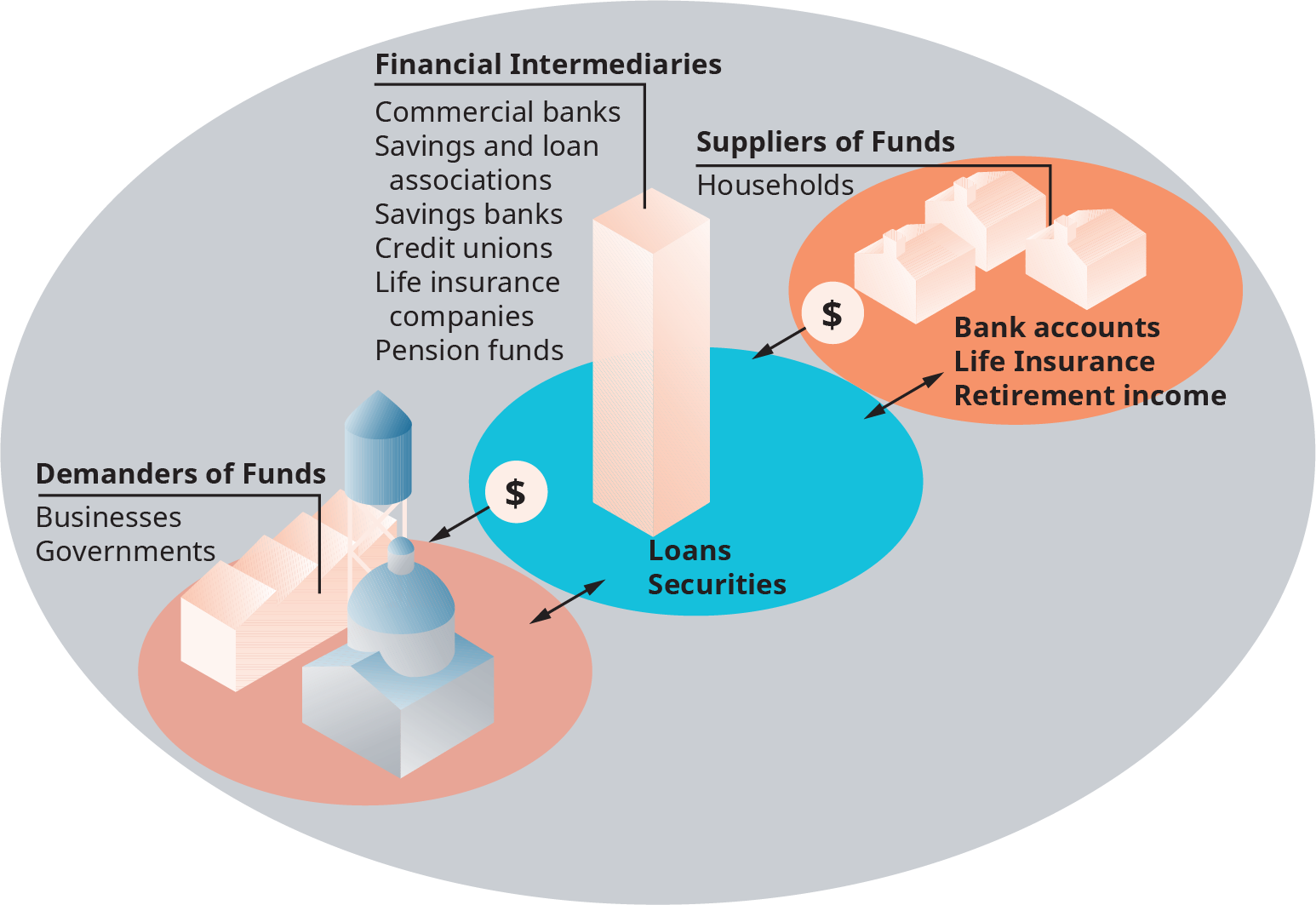

The commercial banks help in mobilising savings through network of branch banking. First they repackage the deposits received from investors into loans that are provided to firms. Mobilising Savings for Capital Formation 2.

Define a commercial bank. Financing Industrial Sector 4. Banks as Financial Intermediaries.

Commercial banks link the central bank. And channelizing them into productive investments. Role of Commercial Banks in Economic Development of a Country Role of Commercial Banks.

Explore where the commercial banks get the money to. They now have. Means of transport are undeveloped.

It receives the state revenues keeps deposits of various departments and makes payments on behalf of the government. The public does not have direct access to financial institutions. Which of the following are direct roles of commercial banks.

Currency and demand deposits are the communitys principal means of payment and media of exchange and are the major components of the money supply. A secondary role of commercial banks is supporting the development of the local economy. Functions of a commercial bank include receiving deposits disbursing payments collections safeguarding money loaning money and.

The most important functions of commercial banks are discussed below. Along with making transactions much safer and easier banks also play a key role in the creation of money. Thus banks lower transactions costs and act as financial intermediariesthey bring savers and borrowers together.

Mobilising Savings for Capital Formation. In this way small deposits by individual investors can be consolidated and channeled in the form of large loans to firms. It keeps the cash reserves of the commercial banks acts as a clearing-house for the inter-bank transactions and as a lender of last resort.

An intermediary is one who stands between two other parties. A commercial bank accepts deposits in the form of current savings and fixed deposits. Explain the role of Commercial Banks in economic development.

The role of commercial banks in the payments system derives from their twin roles as distributor of currency paper money and coin and as producer and servicer of demand deposits. The role of a commercial bank in a developing country is discussed as under. This frees up bank assets.

Financia institutions are intermediaries between savers and borrowers. When a central bank is looking to increase the quantity of money in circulation it purchases government securities from commercial banks and institutions. The commercial banks help in overcoming these obstacles and promoting economic development.

To learn more about the different roles available in a commercial bank see CFIs Careers in Commercial Banking course. The primary role of commercial banks in the developed world is to offer business bank accounts with standard options such as deposits withdrawals and loans. The main purpose of commercial banks is to provide financial services to the general public and also provide loan facilities to the business which helps in ensuring economic stability and growth of the economy.

The customers of commercial banks are primarily looking to finance major consumer purchases. Therefore we can say that credit creation is the most important purpose of commercial banks. Encouraging Rights Type of Industries.

A Survey Of Research On Retail Central Bank Digital Currency In Imf Working Papers Volume 2020 Issue 104 2020

Difference Between Central Bank And Commercial Banks In India With Comparison Chart Key Differences

Investment Banking Vs Commercial Banking Overview Major Differences

Oil Commodity Bank Related Documents Financial Instrument Bank Oils

Corporate Banking Career Path Salary More

Difference Between Commercial Bank And Merchant Bank With Comparison Chart Key Differences

U S Financial Institutions Introduction To Business

Visualizing The Power And Frequency Of Earthquakes Visual Capitalist In 2020 Types Of Innovation Economy Circular Economy

Commercial Bank What You Need To Know About Commercial Banks

Ubs 3q Profitiert Vom Investment Banking Ubs 3q Profitiert Von Investitionen Investment Banking Investing Investing Apps

Stages In Money Laundering Process Google Search Money Laundering Financial Investments Money

Consultant Regulatory Systems Strengthening Pharmacovigilance At Msh May 2021 Mabumbe In 2021 Program Management Strategic Leadership Management Skills

Role Of Commercial Banks In The Economic Development Of A Country Ppt Video Online Download

Hotel Job Openings Bangalore Hotel Jobs Job Opening Job

Digital Music Distribution Competitor Comparison Amuse Digital Music Music Free Music

:max_bytes(150000):strip_icc()/dotdash_Final_Understanding_the_Role_of_the_Fed_Jun_2020-01-02efe1c99128421195f2a3c68737d792.jpg)

Federal Reserve System Frs Definition

Pin By Benjamin Mejia On Playeras Vector Logo Premium Logo Vector

Comments

Post a Comment